Won't affect credit score

Same-day assessments

Visa Holders Welcome

Our Trusted NZ Finance Partners

Our Trusted

Finance Partners

Rated 5 out 5 by Kiwis Across NZ

Rated 5 out 5

by Kiwis Across NZ

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Rated 5 out 5 by 1,000+ Kiwis Across NZ

Rated 5 out 5

by Kiwis Across NZ

One application.

Multiple lenders.

Better deals.

One application.

Multiple lenders.

Better deals.

Complete just one form and we’ll do the heavy lifting. We compare top NZ lenders to secure you a sharper deal on your personal loan.

How it Works

01. Apply once

One simple application gives you access to multiple personal loan lenders instead of applying everywhere yourself.

02. We assess your application

We review your goals, income and credit profile to understand what unsecured or secured options actually make sense for you.

03. We compare lenders for you

We match you with the lenders most likely to suit your situation so you don't waste time on declines or risk unnecessary credit checks.

04. Choose what works for you

You review the loan offers and decide if you want to move forward. The choice is always yours.

Why use Lending Room for your personal loan?

Why use Lending Room for your personal loan?

Lending Room is a NZ loan broker, not a bank or a lender. We’re the helpful friend who knows how to find you a better deal.

Lower Rates, Less to Repay

We compare multiple lenders to secure a competitive rate that lowers your weekly repayments.

Protect Your Credit Score

We assess your profile first to find the right lender and keep your credit rating safe.

We Save You Time

One form, over 15+ lenders. No need to fill out an application over and over.

Fast Decisions

Get a decision fast with most customers sorted within 24 hours or even same-day.

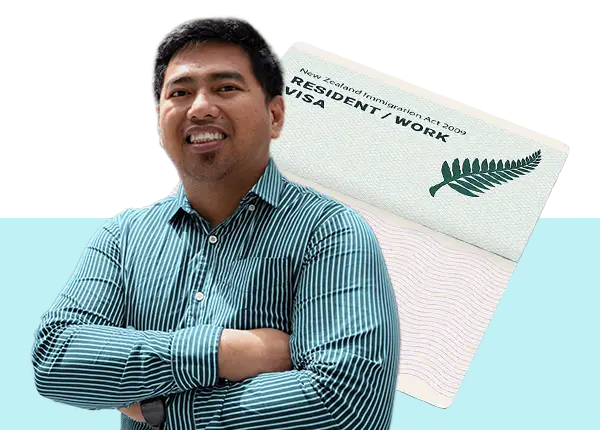

Visa Holders Welcome

We work with lenders who understand newcomers to NZ. Your visa status isn't a barrier.

Expert NZ Support

Our Auckland team handles the negotiation to ensure your entire process is simple and stress-free.

Going Direct vs. Lending Room

Going direct

vs. Lending Room

See how Lending Room stacks up against the competition to get you a better deal.

On a Work or

Resident Visa?

We compare top NZ lenders and negotiate to get you the best personal loan outcome. Rates from 8.99% p.a.*

Won't affect credit score

Same-day assessments

Visa Holders Welcome

*Rate and approval is subject to provider credit criteria. Lender establishment fees, terms & conditions apply.

*We complete a soft-touch credit enquiry during our assessment, which does not impact your credit score. After we determine the most suitable lender and submit your application, some lenders accept this enquiry, while larger lenders may conduct their own standard credit check as part of their process.

Vehicle and Personal Loan Disclosure:

For vehicle and personal loans, the Annual Interest Rate (AIR) and Annual Percentage Rate range from 8.99% p.a. to a maximum of 29.95% p.a., on a minimum loan term of 6 months to a maximum term of 84 months.

Our services are provided in accordance with our Terms & Conditions. The actual interest rate charged to you is determined by the lender and will depend on your personal profile, credit history, the type of lending required, and the security provided (if any).

For vehicle and personal loans, fees apply; including an establishment fee of up to $450 and an introducer/broker fee of up to $1,500.

Representative example of total cost of a loan: A loan of $5,000 over 12 months at 12.95% p.a. has fees totalling $735 and a total repayment of $6,145.20, equating to 12 monthly payments of $512.10.