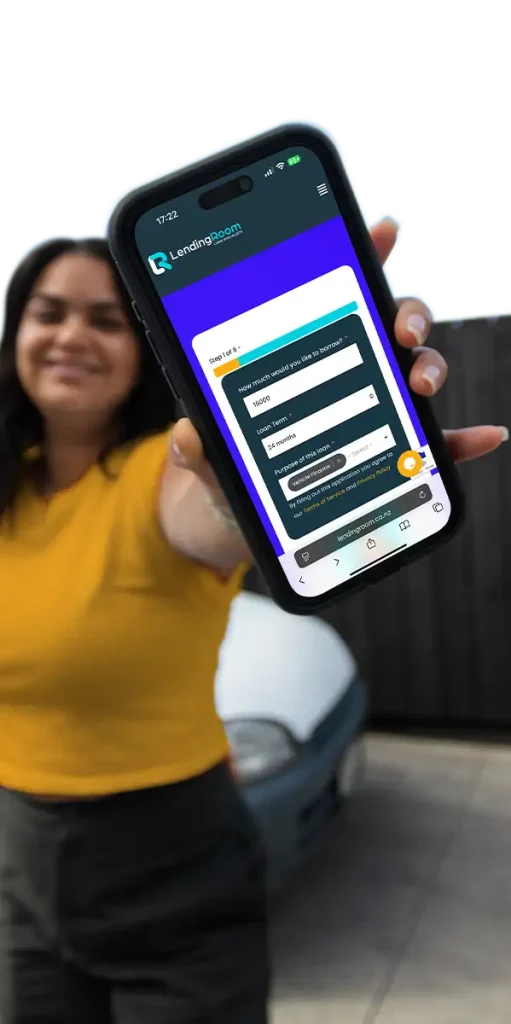

One application. Multiple lenders. Better deals.

One application.

Multiple lenders.

Better deals.

Don’t let multiple credit checks smash your score. We compare trusted Kiwi lenders with one safe application to find your best rate.

Don’t let multiple credit checks smash your score. We compare trusted Kiwi lenders with one safe application to find your best rate. Rates from 8.99% p.a.*

Won't affect credit score

Same-day assessments

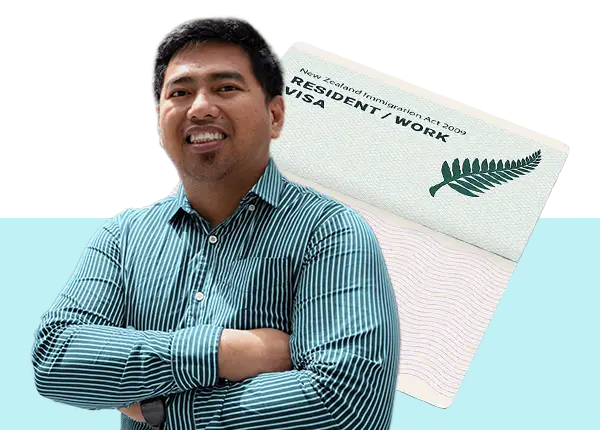

Visa Holders Welcome

Our Trusted NZ Finance Partners

Our Trusted

Finance Partners

Our Personal Loan Process

A personal loan is the flexible way to borrow money for everyday needs. Whether you are looking to consolidate debt, buy a car or cover unexpected expenses, we help you find the right finance solution.

Won't affect credit score

Same-day assessments

Visa Holders Welcome

01. Apply once

One simple application gives you access to multiple personal loan lenders instead of applying everywhere yourself.

02. We assess your application

We review your goals, income and credit profile to understand what unsecured or secured options actually make sense for you.

03. We compare lenders for you

We match you with the lenders most likely to suit your situation so you don't waste time on declines or risk unnecessary credit checks.

04. Choose what works for you

You review the loan offers and decide if you want to move forward. The choice is always yours.

Rated 5 Out of 5 by Kiwis Across NZ

Rated 5 Out of 5

by Kiwis Across NZ

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Why use Lending Room for your personal loan?

Why use Lending Room for your personal loan?

Lending Room is a NZ loan broker, not a bank or a lender. We’re the helpful friend who knows how to find you a better deal.

Lower Rates, Less to Repay

We compare multiple lenders to secure a competitive rate that lowers your weekly repayments.

Protect Your Credit Score

We assess your profile first to find the right lender and keep your credit rating safe.

We Save You Time

One form, over 15+ lenders. No need to fill out an application over and over.

Fast Decisions

Get a decision fast with most customers sorted within 24 hours or even same-day.

Visa Holders Welcome

We work with lenders who understand newcomers to NZ. Your visa status isn't a barrier.

Expert NZ Support

Our Auckland team handles the negotiation to ensure your entire process is simple and stress-free.

Won't affect credit score

Same-day assessments

Visa Holders Welcome

Going Direct vs. Lending Room

Going Direct

vs. Lending Room

See how Lending Room stacks up against the competition to get you a better deal.

Personal Loan Repayment Calculator

Estimate your repayments in seconds. Choose your loan amount, term and rate to see what you’ll repay weekly or monthly.

One Application. Multiple Loan Options.

One Application.

Multiple Loan Options.

Whatever you’re borrowing for, we’ll find lenders ready to help.

Same simple process, any purpose.

Whatever you’re borrowing for, we’ll find lenders ready to help. Same simple process, any purpose.

Personal Loans

Flexible personal loan options tailored to your credit profile, with competitive rates from 8.99% p.a.

Debt Consolidation

Roll multiple debts into one manageable repayment and simplify your finances.

Unsecured Loan

Borrow from $3,000 to $75,000 with no asset required or property used as security.

Secured Loan

Secure larger loans up to $250,000 using property or assets as security, with tailored rates and flexible terms.

Business Loans

Funding solutions to support cash flow, equipment purchases or business growth.

On a Work or

Resident Visa?

We compare top NZ lenders and negotiate to get you the best personal loan outcome. Rates from 8.99% p.a.*

Won't affect credit score

Same-day assessments

Visa Holders Welcome

Personal Loan Rates & Terms Made Clear

Fair interest rates, flexible loan terms and clear fees, explained upfront so there are no surprises.

Loan Amounts

from $3,000

to $250,000

Interest

Rates

from 8.99%

to 29.95% p.a.

Loan Term

from 6 months

to 84 months

Establishment Fee

Up to $450

Introducer

Fee

Up to $1,500

Loan Amounts

from $3,000

to $250,000

Interest Rates

from 8.99%

to 29.95% p.a.

Loan Term

from 6 months

to 84 months

Establishment Fee

Up to $450

Introducer

Fee

Up to $1,500

What can we help you make happen?

Big plans, everyday goals and everything in between. Apply once and we’ll help you find a loan that fits.

We’re perfect for you if you want:

- One safe application that won’t hurt your credit score

- Access to trusted NZ lenders, matched to your situation

- Visa holders welcome, including work and residency visas

- Faster answers so you can move forward with confidence

- Repayments structured to suit your pay cycle and budget

- Clear, upfront costs with no hidden surprises

- A friendly local team to guide you from start to finish

Won't affect credit score

Same-day assessments

Visa Holders Welcome

Frequently Asked Questions

No jargon, no fine print tricks. Just straight answers to common questions.

You’ll usually hear back within the same business day. In most cases we’ll have an update for you within a few hours. If it takes longer it is usually because we are waiting on missing documents like your bank statement, ID or other required information. Once we have everything we need we can move quickly and it will be no more than two working days.

- Be 18 years or older

- Hold one of these photo IDs:

Be a NZ citizen, resident or have a valid work visa with at least 13 months remaining

Earn at least $600 per week paid into your own bank account

Have a good credit history (some lenders may accept limited history for visa holders)

Yes, for personal loans we do charge a fee, this is called a broker or introducer fee. As every application is unique, the fee charged will vary depending on the work and time spent on attaining the loan approval for you. The broker/introducer fee can be added to the total loan amount and is not required to be paid up front.

Yes, you can. If you're on a resident visa or a work visa with at least 13 months left, you’re welcome to apply. You’ll also need to be over 18, earning at least $600 a week in New Zealand, and have a fair credit history.

We work with lenders who are happy to consider visa holders and we’ll do our best to match you with the right option. Apply online and we’ll take care of the rest.

We complete a soft credit check during our assessment which does not impact your credit score.

Submitting an initial enquiry with us allows us to review your situation without immediately affecting your score. When we formally apply to a specific lender on your behalf a credit check will be performed. Using a broker protects your score because we match you with the right lender first rather than you applying to multiple banks and racking up multiple credit checks.

Your interest rate depends on your unique profile, credit history and the security provided. Our rates typically range from 8.99% to 29.95% p.a. By using a broker you ensure you are getting a competitive rate that matches your financial situation

In most cases yes. Many of our lenders allow for early repayment without heavy penalties which can save you significant money on interest. If having the flexibility to pay off your debt faster is important to you let our team know so we can match you with a lender that offers flexible terms.

Not always. We offer both secured loans where you use a vehicle or asset as security and unsecured loans where no asset is required. Secured loans often come with lower interest rates and higher approval chances but we can discuss which option is best for your goals.

Financial News

& Lending Tips

Ready to find your

best personal loan deal?

Ready to

find your best

personal loan deal?

to get a better personal loan deal. Fast and no credit impact.

One quick application. Multiple lenders.

Won’t hurt your credit score.

Won't affect credit score

Same-day assessments

Visa Holders Welcome